Is Bilt Worth it Without Their Credit Card? (updated)

Back in May we reviewed Bilt’s program and asked, “is it worth it without their credit card?” We didn’t give a hard “no” or “yes” but rather our answer was “meh”.

Why? First, we were shocked to discover that for the program all about “rewards for your rent”, the amount of points you could earn for rent without their credit card was shockingly low, capped at 3,000 annually. Second, it takes a lot of work and a shift in your behavior with other brands to rack up enough points that can be redeemed for something meaningful. Is it better than nothing? Sure, it’s a free program. But you have to look at sweat equity versus return, and we think it fell short.

On the plus side, we did like that you can earn points in a myriad of other ways beyond rent, and Bilt has a plethora of redemption options, ranging from great value (transferring points to hotel and airline partners) to horrible value (points to pay rent; points on Amazon).

In our review, we also gave kudos to Bilt for being one of the only brands in the US truly developing a 360 lifestyle rewards program. We added that “…they have made the program more robust in just a few years and months. That gives us hope for the future.” Well, since that review just a few months ago, Bilt has made changes and announced upcoming ones, some for the better, some worse.

So to be fair, we updated this review to take a second look at it. Read on…

Photo credit: Shutterstock

How bilt works:

Anyone can sign up to be a Bilt member, renter or not. While its core concept revolves around rewarding rent payments, it has extended perks for spending around your home and neighborhood, so it’s more of a Lifestyle Reward program. Here’s how to get started:

Link Your Cards – Connect your Amex, Visa, or Mastercard debit/credit cards to Bilt to track eligible spending and earn points from their partners (such as Walgreens, Lyft, restaurants, etc).

Rent Payments:

If your home is INSIDE the Bilt Alliance network: Pay rent via Bilt’s app or website and earn points. Simple.

If your home is OUTSIDE the Bilt Alliance network: You can still earn points, but Bilt will process your rent payment via check or ACH for a fee: $9.95/month for debit or 3% (minimum $3) for credit. Ouch.

Once set up, here are ways to earn points:

Rent (options):

If you pay through the Bilt App or website via ACH or Debit card, you'll earn 250 points per on-time monthly payment, with a maximum of 3,000 points annually. For a program built around rewarding rent, calling this a disappointment is an understatement.

If you pay via a Visa, Mastercard, Amex or Discover (that’s not their cobrand Bilt credit card), as of July 21, 2025 you will earn 1 point per $2 spent on rent paid via the Bilt app or website. So if your rent is $2500 a month, in a year you’d earn 15k points. Much better than the 3000 cap. But also concerning that this used to be 1 point per $1 for all non-Amex cards and now it’s half the value. A bit concerning and a devaluation.

⚠️ However, when paying via this method, you are charged a transaction fee, likely 3%, by your bank. So that $2500 rent example will cost you $2575. On an annual basis you will pay $900 in fees to earn 15,000 points. Hmmm…..that doesn’t seem worth it. Even if you can squeak out 2% in value via some transfers, those 15k points are worth $300 (best), putting you WAY under water vs your fees.

Rideshare: 2x points on Lyft when accounts are linked.

Dining: 2x or 3x points at participating restaurants when using linked cards.

Fitness: Points for classes at Barry’s Bootcamp, CorePower Yoga, SoulCycle, etc., if booked via Bilt. Sometimes you’ll get freebies like a smoothie or water bottle for being a member.

⚠️ If you have a membership where you pre-pay for classes (like at Barry’s, where the more classes you buy the better the rate) you can’t apply that via Bilt. You earn points only when you buy a class via Bilt. So it’s good you earn points, but you’ll likely spend more per class than if you bought a package directly.

Pharmacy: 1x or 2x points at Walgreens, plus 100 points for prescription refills.

Travel: 1x points when booking through Bilt’s travel portal.

Home Decor: 1x points on Bilt’s curated “Home Collection.”

Home Purchase: 1 point per $2 spent if buying a home via Bilt’s partner agents at eXp realty.

Rent Day Bonuses: On the first of each month, Bilt offers special promotions, exclusive merch drops, and boosted redemptions

Tier Status-Worth the Grind?

Bilt has 3 elite tiers, which you can achieve by either earning a set number of points annually or by spending enough through Bilt’s platform (note: ironically rent payments don’t count toward fast-tracking status). Given the high spending or point thresholds required, the perks are mostly underwhelming—unless discounted or free helicopter rides (yes, with BLADE) are your thing. Putting that snark aside, the best thing on the list for the higher tiers is the higher rent day (1 day a month) transfer bonuses which could give you excellent value. But in the next section you’ll see how hard it is to GET to the higher levels without their Bilt credit card.

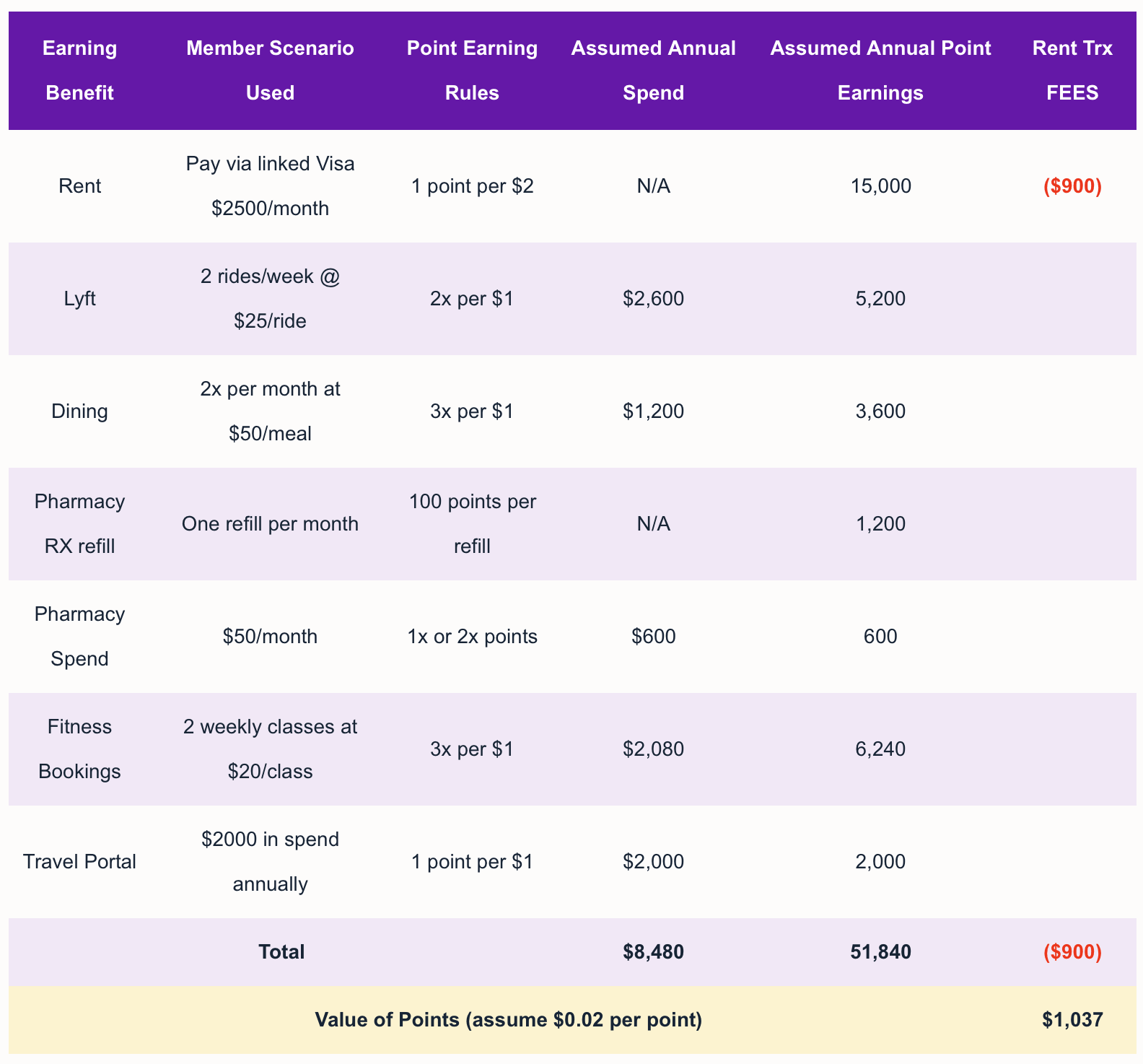

earning potential

Scenario #1: Hypothetical Bilt member who…

Pays $2500 monthly rent via ACH.

Actively takes advantage of most earning opportunities.

Because the rent-earning rate is abysmal, you’d need to shift your behaviors to maximize points—like using Lyft over Uber, dining at partner restaurants a lot, and booking fitness classes through Bilt. Achievable? Yes. Effortless? No.

And we didn’t include home buying as a viable earning strategy because, let’s be real, picking a real estate company to earn points when making one of the most significant financial decisions of your life is not something we can get behind. You need a good realtor. Period. Ask around from family and friends for reccos. Don’t pick one at random via a website like Bilt just to earn points (even though we realize you will see 🤑 by earning hundreds of thousands of Bilt points).

💡 By our calculation (chart below), this member would rake in just under 40k points a year, which isn’t even enough for Silver status. The value of 40k points? At 2 cents/pt (generous assumption but let’s go with it), that’s $800 in value, which is good and worth something substantial. But if you only earn on rent, those 3000 points are worth only $60.

Scenario #2: Hypothetical Bilt member who…

Pays $2500 monthly rent with their linked Visa.

Actively takes advantage of most earning opportunities (same as our previous scenario)

💡In our chart (below), this member would earn over 51k points annually (yay, silver status!), but would pay $900 in annual transaction fees by paying with a linked credit card. Those 51k points are worth over $1,000, so you come out ahead…but barely. If you don’t earn enough points via non-rent transactions, you could end up underwater in value.

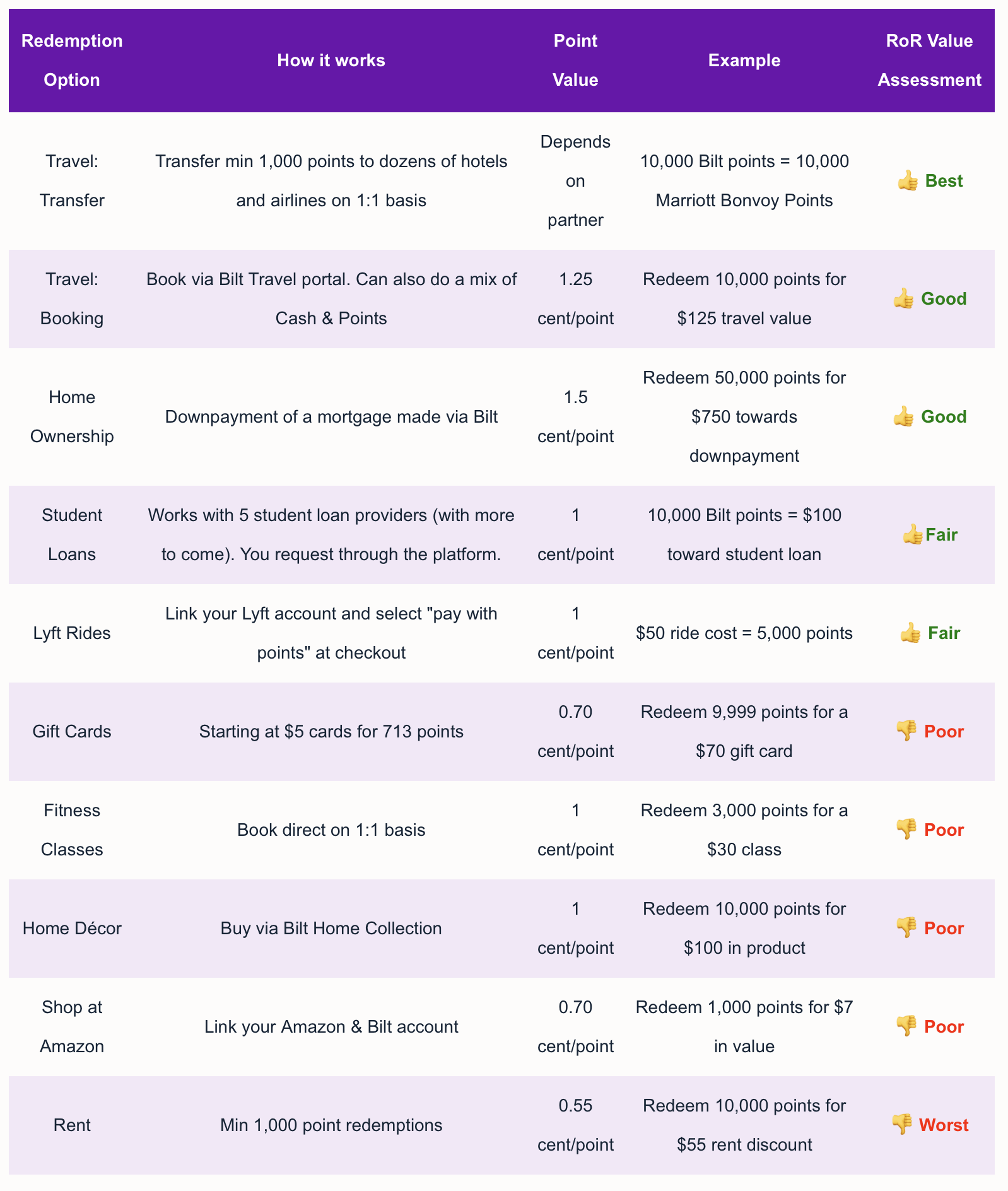

redemption-What’s the Value?

Bilt offers plenty of ways to redeem points (great!), but value varies widely (not so great). Here’s how they stack up for a Blue (basic) member:

Best Value: Transferring to a plethora of airline and hotel partners at a 1:1 ratio, making it a solid way to top off your travel rewards for your favorite programs.

Worst Value: Paying rent. The rate? Half a cent per point. For a program that built its name on rewarding rent, we again are surprised how bad everything related to rent is!

Most convenient: Syncing your Bilt and Amazon accounts or Bilt and Lyft account allows you to shop/buy with Bilt points. The value is eh, but the process is easy, and there is no minimum redemption.

Biggest hassles: Rent, again, unfortunately. And similar set up having to sync your student loan account for redemption which might not be worth the hassle depending upon how many points you have.

Rent Day promotions (on the 1st) often boost redemption values, so keep an eye out for those.

Pros & Cons of Bilt Rewards

(Without the Credit Card)

Pros of the program:

1. Earn on everyday spending: Other than switching from Uber to Lyft or CVS to Walgreens, you can easily earn for the things you were already doing, like dining out at local restaurants and watching points roll in automatically.

2. Myriad of earning & redemption options: Bilt is adding new options all the time so this program will likely get even more robust than it already is. And the value of the travel transfer and travel portal is very good.

3. User-friendly site: Easy to navigate to keep track of points, status, and earning and redemption opportunities.

4. Frequent promotions/deals: Rent day deals can be solid.

Cons of the program:

1. Rent earning & redemption value is terrible: To max out at 3,000 points annually on rent it’s literally not worth the effort, and if you link a credit card, you will incur a fee that essentially negates any value from the points earned. And the redemption value is so bad you’d be crazy to use your points to decrease your rent.

2. Many mediocre redemption values: Many are just ok to poor. Transferring points to hotels and airlines offers the best option, but the rest are just ho-hum. If you are a traveler you’ll be satisfied, otherwise you might be disappointed.

3. Elite status is hard to achieve:: And even if you do the Perks aren’t exciting until you get to Platinum.

4. Earning requires a shift in habit: To maximize points, you need to actively book fitness classes, travel, and dining through Bilt’s partners via their site and will likely spend more than if you just used a regular credit card that you earn points through. Passively linking your cards gets you earning at Lyft, restaurants and more, but it would be hard to rack up massive points.

summary:

It’s not an enthusiastic yes, but it’s not a hard no either.

We should say we love the concept of what the Bilt team is trying to do here- give Americans a program that rewards their everyday lifestyle choices. And they do run a lot of great rent day promotions.

But if you planned to sign up, pay your rent, and watch the points roll in, don’t bother. This is NOT the program for you as it’s not highly rewarding for rent. But if you’re willing to stay engaged with the site frequently, shift spending habits a bit, and use their site for more things, you can earn enough points to give you something of moderate value. It doesn’t hurt to link your cards and earn via dining, Lyft, and Walgreens as those require little effort after linking. It’s free extra points, why not!

Would Bilt be better with their credit card? Absolutely, as all loyalty program cobrand cards deliver way more value than the free programs. But if another card is not what you are after, our recco is to NOT pay rent via Bilt and just earn Bilt points on the other earning opportunities, then transfer those to your hotel or airline of choice for a good return value.

👩🏻⚖️ Our Verdict:

For Bilt without the credit card, we’re giving this a Meh. We were underwhelmed with the earnings from Rent and the work required to earn points via other categories.

Leave us a comment! Do you agree or disagree? Any further tips about Bilt Rewards?